What is the minimum cost to set up a company? Explain according to the main legal person form | Entrepreneurship manual of entrepreneurship, entrepreneurship and fund-raising

Thorough explanation of the cost of establishing a company by company form and procedure!

I'm worried about how much it costs to establish a company.The amount depends on the procedure and the form of the company.

Here, while explaining the differences between a stock company and the joint company, we will introduce the cost of establishing each form of a company.We will also explain how to reduce the flow and costs to the establishment, so if you are considering the establishment of a company, please take a look.

The explanation here is the legal cost of the registration procedure.It is necessary to separate the cost of requesting an expert and the cost to set up an office.These will be described later.

* In the "Founding Handbook" that writes this article, more fulfilling information is also explained in the thick "Founding Handbook / Printing Version".Please order it because you can get it for free.

Contents of this article

By form!Costs for establishing a company

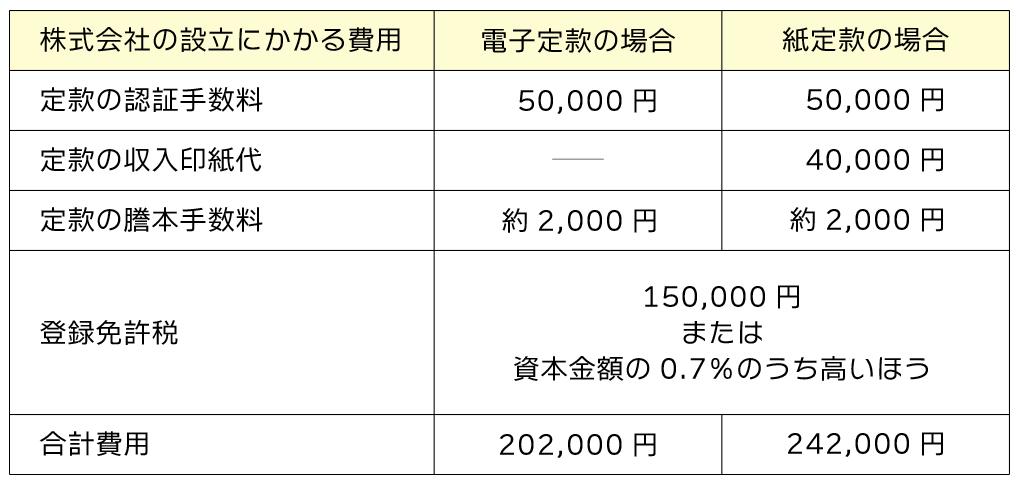

Here, the market price of the statutory cost (registration procedure) for the establishment of a company is divided into "paper articles of incorporation" and "electronic articles of incorporation".The market price will be the amount of money that will actually be slightly higher and lower, because the price will be excluded from requests for experts and the cost of equipment for the office, but let's check it as a reference for the cost.

The statutory cost for the establishment of a corporation is 242,000 yen for the paper articles of incorporation and 202,000 yen for the electronic articles of incorporation.As shown in the table above, the cost of the establishment of a stock company will be the difference of 40,000 yen in revenue stamps depending on whether the paper articles of incorporation or the electronic articles of incorporation.

In the first place, the articles of incorporation are the basic rules required to operate the company.The articles of incorporation specify the company name, location, the purpose of the company, the name of the founder, the amount of capital (the amount of capital), and the total number of shares that can be issued.

If you are establishing a stock company, you must be certified by the articles of incorporation.If you want to reduce the cost of establishment of a stock company, you should be certified in the electronic articles of incorporation.

Next, let's take a look at the cost of establishing a joint company.The establishment of a joint company does not require authentication of the articles of incorporation.For this reason, the cost of establishment procedures is lower than in stocks, 100,000 yen for paper articles of incorporation and 60,000 yen for electronic articles of incorporation.

ただし、株式会社と合同会社は互いに異なる特徴を持つので、設立コストだけを比較して、良し悪しを決めることはできません。具体的なそれぞれの特徴とメリット・デメリットについては後述します。

The cost of establishing a company is divided into three

The cost of establishing a company is divided into the following three types.

Let's look at each.

The statutory cost is the cost for the legal procedure required to establish a company.It is consistent with the cost of the articles of incorporation and the cost of registration, and it is a cost that will always be paid if you establish a company.

However, as mentioned above, there are differences in the statutory cost depending on the form of the company.The legal cost of a limited company (electronic articles of incorporation) is 60,000 yen in total, but in the case of a stock company (paper articles of incorporation), it is 242,000 yen, so there is a difference of 182,000 yen.

The capital is the money to transfer to the founder's bank account when establishing a company.After transferring, it can be used as a company working fund.Capitals are the money that can be spent to purchase office rent, employee salaries, and purchase equipment at the beginning of the establishment.

The amount of capital can be determined freely.With the revision of the Companies Law, neither the corporation and the joint company to be established from the capital of 1 yen.There is no upper limit.However, it is important to note that if the capital exceeds 10 million yen, the consumption tax will be paid from the first year of the company.

If the capital is not enough and there is a risk of working funds, consider using the founding loan.A founding loan is a loan system that can be applied immediately after starting a business.This is the new founding loan of the Japan Finance Corporation and the system loan of each local government.

In the procedure of establishing a company, you will need other expenses.

I will explain each.

If the articles of incorporation are electrons instead of paper, income stamps will not be charged, and the cost of establishment will be reduced accordingly.However, when creating an electronic articles of incorporation, you must prepare a My Number card and IC card reader required for electronic signatures.My Number Card can be created for free, but it costs about 2,000 to 3,000 yen to purchase an IC card reader.If you take a photo of My Number Card with a photo studio or speed photo, you need a separate photo fee.

Also, if you buy software to make the articles of incorporation created on paper, look at the cost for that.In the case of Adobe Acrobat, the package version is about 30,000 yen, and the monthly billing type is about 2,000 yen per month.If you want to keep costs down, use free software or use the free trial period.

When registering a company establishment, a corporate seal is required.Therefore, the cost of creating a seal is also included in the money required at the time of establishment.

The seals needed to run the company are real seals, bank seals, and square seals.It is often sold in a set of three, and the price varies depending on the order.In addition, after the establishment, a rubber stamp will be needed to do business.

When a new company is established, a seal certificate of the founder / executive (in the case of a stock company) or a representative employee (in the case of a joint company) is required.It can be obtained at the municipal office for about 300 yen per pass.

Social insurance refers to health insurance, employee pension, employment insurance, work -related accident insurance, and long -term care insurance.Employment insurance and workers' accident insurance are sometimes referred to as labor insurance.

If you establish a company, you have to take out social insurance regardless of employees.However, employment insurance and workers' accident insurance will be enrolled if there are employees who are employed.

There is no cost when joining, but after joining, the company and individuals will bear the insurance premium according to their own burden (full of workers' accident insurance will be borne by the company).Be sure to join because you may be subject to penalties if you do not join.

Social insurance costs are not required when the company is established, but the procedure is required at the same time as the company establishment, and it is a cost that will continue to occur after that, so keep it in mind.

Column: Easy to establish a company!What is Yayoi's simple company?

会社設立のためには、定款をはじめ、数多くの書類を作成することになります。しかし、新しく会社を作る時には、事業をスタートさせるための営業活動や広告宣伝、事務所や店舗の用意など、設立手続きのほかにもやらなければいけないことが数多くあります。そこで役立つのが、「弥生のかんたん会社設立」です。弥生のかんたん会社設立サービスを利用すると、会社設立に必要な書類作成や電子定款の作成を無料で行えます。また、複雑な手続きについて、いつ何をやらなければいけないのかフローで案内してもらえる点もメリットです。やるべきことが可視化されるため、抜け漏れを防いで確実な手続きが行えます。会社設立に必須の印鑑の購入や、設立後に役立つ会計ソフト(弥生会計 オンライン)の特典もあるので、ぜひ活用してください。

What is the difference between a corporation and a joint company?

株式会社と合同会社には、設立費用をはじめ、数多くの違いがあります。どちらが自社に適しているのかを知るために、会社組織のあり方の違いや、それぞれのメリット・デメリットについて知っておきましょう。

The same is true that both the corporation and the joint company can be established by one person, and that the capital should be from 1 yen.However, since all employees are investors in a joint company, if there are two or more employees, the minimum amount of funding will be "1 yen x number of employees".

In addition, the highest decision -making agency is composed of both investors (shareholders / employees), both in the case of a stock company or a joint company, but the management is not necessarily a directors (investors.), There is a difference in employees (investors) at the joint company.

In the case of a joint company, there is no "employee who does not invest", but it is possible to set up an employee who does not only invest and is not involved in management.

The benefits of the corporation can be mainly consolidated in the following two points.

Being able to earn social trust is a benefit, such as being able to get loans from financial institutions, easy to pass by business partners, and to hire human resources.

Also, if the company goes bankrupt or damages the business partner, the shareholders are only responsible for the amount of investment.This responsibility is called indirect liability and is not required by business partners.

The disadvantages of establishing a corporation are mainly the following two points.

The cost of the establishment is as described as already explained.You will need a fairly expensive cost compared to the establishment of a joint company.

In addition, the procedures for establishment are complicated, and after the establishment, it is necessary to manage many laws and regulations on organizations and management.For procedures that require specialized knowledge, you will be outsourced to external experts, such as judicial scriveners and tax accountants.

The following three benefits to establishing a corporation as a joint company are the following three points.

The cost of establishment is as described above.In addition, since employees are the highest decision -making organizations, there is no need to worry about shareholders will affect their management policies.The lack of obligations for the financial statements will also reduce the burden on the manager and take the time to spend time in the core work.

There are two disadvantages of a joint company.

Because the joint company is not aware of the corporation, it may be difficult to obtain trust from business partners.

Also, it is not suitable if you want to grow a company large because it cannot be listed.Nevertheless, it is possible to change from a joint company to a stock company, so it is possible to first establish a joint company in relatives, and change the business to a stock company after the business is on track.

The detailed differences between the corporation and the joint company and the points of how to choose are explained in the past article, "Let's learn the differences between the joint company and the stock company and choose a corporate case that does not fail."Please check together.

関連記事合同会社と株式会社の違いを知り、失敗しない法人格選びをしようThe above table is a comparison of the cost of establishing a stock company and a limited company.The fact that the total cost is different is the presence or absence of authentication at the notary public office and the amount of registration license tax.

On the other hand, the income stamp fee required in the case of paper articles of incorporation does not change.By making the electronic articles of incorporation, the cost of 40,000 yen can be reduced, both in the case of a stock company and a joint company.

The types of companies include a stock company and a joint company, as well as a limited company.However, a limited company cannot be newly established.This is because the company law was amended on May 1, 2006, and new establishments were no longer approved.

Until then, the establishment of a stock company required a capital of 10 million yen or more, three or more directors and one or more auditors.A "limited company" is a corporation that loosens these conditions and can be established for more than 3 million yen.

Since the company's law revision has been able to make a stock company from 1 yen, there is no reason to choose a limited company.Therefore, there is a history that the system itself has disappeared.However, the company established by April 30, 2006 is still a corporate status and can continue the business.

「弥生のかんたん会社設立」を使用すると、会社設立の手間とコストを削減できるとともに、会社設立後に役立つ会計ソフトなど各種サービスのサポートも受けられます。

詳しくはこちらThe flow of the company and the period of the guide

次に、会社を設立するまでに具体的にどのようなことをすればいいのか、その具体的な流れを見てみましょう。

The company is not something you can do right away to make it.Let's proceed with the procedure systematically.Comparing a joint company with a corporation, the period of the company establishment procedure is short because the limited company does not need to receive the articles of incorporation.

In order to establish a company, it is necessary to first determine the information that must be described in the articles of incorporation.Specifically, the following 5 points.

In particular, the company name can be said to be the face of the company.Check carefully after checking if you can get a domain or if there is a company with a similar name.

In addition to this, it is necessary to consider when the business year will be disclosed or private, and the executive structure and terms of term.These information can also be described in the articles of incorporation.

In particular, it is common to describe the presence or absence of a share transfer and the executives by describing it in the articles of incorporation.

Next, create an articles of incorporation.The contents described in the articles of incorporation are divided into three types: absolute description, relative description, and optional items.The absolute description is the following 5 points that must be written in the articles of incorporation.

In addition, the relative description is a rule that can demonstrate the effect of operating a company by describing it in the articles of incorporation.The presence or absence of stock disclosure is applicable.

The optional items are items that do not affect the effect without listing.The business year, etc. correspond.

When establishing a corporation, submit the articles of incorporation to the notary public office and receive certification.Let's complete the procedure at the notary office that has jurisdiction over the location of the main store.

The documents required for the articles of incorporation are as follows.

However, if an agent such as a creator goes to authenticate, a separate seal registration certificate, a power of attorney, and an agent's identification card are required.

Regardless of the paper articles of incorporation and electronic articles of incorporation, when going to the articles of incorporation, it is necessary to check the contents of the articles of incorporation in advance and adjust the schedule with the notary public office.Check with the notary public office in your jurisdiction for details.

You need capital to establish a company.However, at this point, the registration has not been completed yet, so it is not possible to open a bank account in the name of a corporation.Therefore, first deposit money to the founder's personal account.If you have more than one founder, make a transfer instead of deposits so that you can see who paid.

In addition, an account does not need to be opened and you can use an existing bank account.Choose an account that will be issued a passbook because you need a copy of your passbook.

When the transfer of the capital is completed, take a copy of the passbook page and the passbook that shows the transfer contents to create a payment certificate.In the payment certificate, the total amount of the payment amount, the number of shares issued at the time of establishment, the date of payment, the address, the company name, and the representative director, and press the representative.

In addition, this capital will be moved there when the corporate account is opened.

Once the above is completed, it is finally an application for a corporate registration.Bring the required documents and registration license tax to the Legal Affairs Bureau, including the registration application form.If there is no problem with the documents, the registration will be completed in about 7 to 10 days.Since the completion notification does not come in particular, it is possible to think that the registration has been completed if there is no contact for about 10 days.

The "company establishment date" is the day when the registration application form is submitted to the counter.Be careful if you have the desired establishment date.

Once the company is registered, perform various procedures required to start the actual commercial transaction.

For corporate accounts, it takes about half a month to one month from application to opening.Let's complete the procedure as soon as possible.In that case, applying for Internet banking will improve the work efficiency later.Not only will you be able to confirm payment and transfer procedures to reduce labor, but you can also simplify accounting processing by linking with accounting software such as Yayoi Accounting.

For the procedure until the company establishment, please refer to the past article, "[Save version] Gently explain the flow of the procedure of establishment of Co., Ltd.!"

関連記事【保存版】株式会社設立の手続きの流れを5つのステップでやさしく解説!Journal and handling of costs at the time of establishment

会社設立に際して必要な費用の中には、設立日よりも前に支出するものもあります。こうした費用も、すべて会社の経費として計上することが可能です。会社設立時にかかった費用の仕訳方法についてまとめました。

The founding cost is the cost from the start of the establishment to the end of the establishment procedure.The following costs are applicable.

Be sure to keep the receipt for these expenses.

The cost of starting a company to start business is called the opening fee.The following applies.

Specifically, the cost of purchasing the company's air conditioner and desk, the printing cost of envelopes and pamphlets, and the creation of a company website.Opening expenses, such as rent, utilities, and salaries of the office before opening, are not included in the opening expenses.

The founding cost and opening costs with similar characteristics are different from the cost of the founding expenses, and the cost of opening the cost of opening the company to start operating.

For example, if the company was established on April 1, and after the recruitment of employees, the company started full -scale sales from May 1st, the expenditure up to March 31 will be the founding cost, and April 1st.Expenditures from April 30 will be the opening fee.In addition, it is not possible to pay tax -up and open costs for ordinary expenses.

The founding and opening costs are not a general expense, but as "deferred assets".

Deferable assets are the benefits of expenditure over a year or more for a year or more.In addition to the year you spent, you can also be amortized after the following year.

In the case of small and medium -sized enterprises, the expenses corresponding to the deferred assets can be amortized in any year.

In general, it is not the first year of establishment of a company with low sales, but it is common to amortize for several years from the following year, when sales will increase and taxes increase.

Here are some examples of specific journal methods paid for the company's establishment costs.Understand the features of the founding and opening costs before doing the right journal.

| 借方 | 金額 | 貸方 | 金額 |

| 仕訳なし | 仕訳なし |

This is the case when the founder has replaced the "founding costs" required to establish a company.In this case, no journal will occur because no corporation has been established at the time of replacement.

However, please keep the invoice or receipt as it will be recorded later as the founding cost.

| 借方 | 金額 | 貸方 | 金額 |

| 創立費 | 300,000 | 現金 | 300,000 |

The founding costs that the founder have been replaced will be settled after the company is established.The journal method in this case is as described above.

If you do not settle, you will be treated as a borrowed money as "executive borrowing".

| 借方 | 金額 | 貸方 | 金額 |

| 開業費 | 100,000 | 普通預金 | 100,000 |

Since the market research fee for preparing for opening a business corresponds to the opening fee, the debit is not "market research fee" but "opening expenses".If you pay from the capital deposited in the bank account, the loans are "normal deposits".If you bring out your capital and hold it as cash, it is "cash".

| 借方 | 金額 | 貸方 | 金額 |

| 創立費償却 | 300,000 | 創立費 | 300,000 |

| 開業費償却 | 100,000 | 開業費 | 100,000 |

If there is a cost of 300,000 yen for the founding fee and the opening fee of 100,000 yen, small and medium -sized enterprises can be amortized at any time.Therefore, if the first year is deficit, it is possible to extend without depreciation processing.

At any time when the profit is made, we will amortize the founding and opening costs as described above.The timing of depreciation is no matter where it is.

Such accounting operations are essential for running the company.We recommend that you introduce accounting software to focus on your main business.

弥生会計 オンラインは簿記/会計の知識がなくても使える機能と画面設計で、はじめてでもかんたんに使うことができます。詳しくは下記のボタンよりご確認ください。

弥生会計 オンラインとはHow much does a judicial scrivener or administrative scrivener cost?

定款の作成から登記まで、すべてを専門家に依頼した場合の相場は8万円~10万円程度です。なお、登記まで一貫して専門家に任せたい場合は司法書士に依頼しましょう。登記手続きの代行は、司法書士にしかできないためです。

If you want to outsource only the creation of the articles of incorporation, administrative scriveners can respond.Since the administrative scrivener is also applying for a licensed application, it is possible to collect the report to the government office, the application for applications, and the creation of articles of incorporation.In addition, the procedure for establishing a company can be done by yourself, or you can ask a judicial scrivener to work on your behalf.The features in each case are as follows.

The biggest advantage of establishing a company by yourself is that you can reduce costs.The registration costs of the above -mentioned stocks and joint companies do not include the commission to pay for experts.If you want to minimize the cost, you should do your own procedure.

No special qualifications are required to establish a company that is the founder.From the creation of electronic articles of incorporation to registration procedure, it is also possible to do it yourself.

If you register the establishment in the electronic articles of incorporation yourself, you can significantly reduce the cost of establishment.It takes the effort of checking the articles of incorporation so that there is no deficiency, preparing an IC card reader writer, and acquiring an electronic certificate, but you will also acquire tax knowledge and laws related to the establishment of a company.

It is recommended for those who want to establish them without cost, those who have time to spend time, and those who want to do their own procedures while learning about the establishment of the company.

Among the company establishment procedures, there are also judicial scrivener offices that respond to the creation of electronic articles of incorporation at a low price.If you ask such a place, you will be able to establish a company with reduced effort.

As you ask an expert, the fee will be charged, but the cost will be reduced rather than requesting everything until the registration.This is a good way if you want to take the middle of your own or ask an expert.

If you ask a judicial scrivener or other experts, you can set up a company without effort.

Although it costs money, there is no need to worry about the lack of documents or deficiencies, and you will be able to start a company on the schedule you want.It is also attractive to be able to spend time on the establishment procedure to the company's core business.

In the establishment of a company, everything can be left to experts from the creation of the articles of incorporation to the registration procedure.It is necessary to provide information such as the company name, the address of the head office, and the founder, but it is easy to follow all the points, when and what to decide, so it is easy to do without knowledge.A company can be established.

Of course, it costs money, but you don't need time to find out how to establish and prepare documents, so you'll be able to concentrate on opening a business.In addition, as mentioned above, it is possible to reduce the cost by leaving only a part of the articles of incorporation.

To reduce the cost of establishing a company

He explained that the cost of establishing a company is divided into the following three.

Of these, the statutory cost is determined by the law.It is possible to reduce costs by using an electronic articles of incorporation or a joint company, but it is impossible to save any further.The capital is also necessary for the company's management, so it is not necessary to save it unnecessarily.

そうなると、費用を抑えるための重要なポイントとなるのが「その他の費用」です。定款の作成や登記にかかる司法書士手数料は、ここに含まれます。8万円~10万円とまとまった金額ですから、自分でできれば大きな節約になるでしょう。

However, it is not easy to do the procedure yourself.Therefore, we recommend using the company establishment support service.By using these services, even those who do not have the knowledge of the company establishment can perform the establishment procedures in their own way.

Reducing the cost of establishing a company using "Yayoi's Easy Company Establishment"

「弥生のかんたん会社設立」は、法人向け会計ソフト「弥生会計」が提供している無料の会社設立支援サービスです。弥生のかんたん会社設立を活用することで、会社設立の手間とコストを削減できるとともに、会社設立後の手続きのサポートも受けられます。

画像出典元:「弥生のかんたん会社設立」よりIf you use Yayoi's simple company establishment, even those who do not have expertise can establish a company by electronic articles of incorporation.Both are compatible with both corporations and joint companies, so enter the information according to the form.

If you use Yayoi's simple company establishment, you can easily complete the company.First, launch the service and enter the following information according to the guidance.

画像出典元:「弥生のかんたん会社設立」より

Once the input is completed, we will create an electronic articles of incorporation for free.The authentication of the articles of incorporation will be completed by selecting the notary public office under the head office and preparing the articles of incorporation in accordance with the guidance, and the articles of incorporation will be certified at the notary office.You can navigate what you need to do next on the chart type, and even if you do not know, you can easily contact us from the question form on the Web, so even those who are not familiar with personal computers can use it with confidence.

Yayoi's simple company registration and service fees are all free.There is no fee for creating an electronic articles of incorporation or an electronic signature fee by experts.

The free period is not set, and it can be used for free forever, so the details such as the company name have not been decided yet, but I want to see the future flow. "It is also recommended for those who want to try it first. "

When the company is established, it is necessary to submit documents in various places, such as pension offices, tax offices, and prefectural tax offices after the registration is completed.

With Yayoi's simple company establishment, the necessary documents and procedures can be supported in steps for procedures that must be performed after registration.Some documents can also be created from the service, reducing the time and effort required to create documents.

The establishment of Yayoi's company, which can be used for free and supports the procedures after the company's articles of incorporation, registration, and registration, is perfect for those who want to easily establish a company with low cost.You can easily register just by entering your email address and password, so please try it.

詳しくはこちら(Supervision: Yayoi Co., Ltd.) (Edit: Founding Handbook Editorial Department)

このカテゴリでみんなが読んでいる記事1位会社設立【最新版】合同会社設立の教科書|設立の流れや費用、メリット・デメリットを徹底解説2位会社設立【保存版】はじめてのNPO法人設立|メリット、設立費用、期間、条件は?3位会社設立【保存版】株式会社設立の「全手順」と流れを創業手帳の創業者・大久保が詳しく解説!