Engadget Logo Engajet Japan Sprint Sale "Investment results are 3 times", SoftBank G Masayoshi Masayoshi appeals

The SoftBank Group (SBG) is the aim of selling the US mobile company Sprint.Masayoshi Son, led by the company, appealed to the results of Sprint investment, saying, "Success as a strategic holding company."Since SoftBank acquired SPRINT in 2013, it has been working on improving management, but it is hard to say that the result has fallen from 3rd to 4th place in mobile phone users.。Mr. Son said, "The basic strategy from the time of entry is to acquire the third place Sprint and the 4th place T-Mobile and bring it to the" Three Kingdoms "with the higher AT & T. Verizon. Inside the company," If the merger is not completed.I'm not going to enter. "

Related article: The US Department of Justice approved the merger with SPRINT and T-Mobile under SoftBank.Conditions are "Rival development"

On the other hand, Son explains that Sprint acquisition is a "investment" as "SoftBank Group is a strategic holding company".The amount spent by SoftBank when acquiring Sprint is 2.1 trillion yen.However, the company contributed by the company is 0..It is only 4 trillion yen, and the rest are all covered by borrowed money.If Sprint acquisition is established and borrowing is repaid, the value of the Sprint stock that the company gets is 1.It is expected to be 3 trillion.Mr. Son said, "If you look at the results of Sprint investment as a strategic holding company, 0..1 with 4 trillion yen.I get 3 trillion yen. "As a summary of investing in SPRINT, Mr. Son said, "I had a lot of suffering. I took a lot of time and effort. It was a dangerous road."While many Japanese companies failed in overseas investment, it would be not bad to be able to return a trillion yen amount. "

In addition, the sale of the profit -bearing debt that Sprint had due to the sale will be out of the SoftBank G's consolidated financial results.Mr. Son said, "I have never been obliged to repay. I was borrowed with a consolidated balance sheet on accounting, but in fact, we never borrowed."By the way, according to Mr. Son, this "separation of interest -bearing debt" also applies to Softbank Co., Ltd. (SBKK), which was listed last year, so all SBKK borrowings can be repaid with SBKK's own capital.He explains that if SBKK falls into management difficulties, if SBKK falls into a management difficulty, if the company is separated, the interest -bearing debt of the SoftBank Group will decrease.

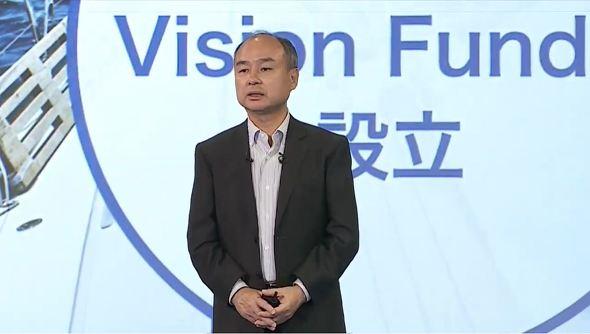

Mr. Son said, "I use borrowing as much as I can, but I use borrowing.It is said that it fails. If successful, you can make a big profit from your borrowed money. "Even after the sale of SPRINT, SoftBank has 27 stocks of the new company (T-Mobile) after the merger..It is to hold 4 %. Regarding the US mobile business after the sale, Mr. Son said, "I think it will be the same as Alibaba for us. We do not control Alibaba's management, but we have Alibaba stocks. It is useful as the core of the Chinese business, which has a positive impact on Chinese investment. In other words, we will hold it while balancing our funding demand and the impact of positive. " "Sprint with Sprint" states the possibility that SoftBank will provide services such as Uber and door dash invested by SoftBank to new T-Mobile users with 100 million users. In the future, the SoftBank Group has strengthened his personality as an investment company, and has invested in technology companies centered on SBKK and SoftBank Vision Fund. It has also announced that it will establish a new SoftBank Vision Fund 2.

Related article: 12 trillion yen "Vision Fund 2" Is it okay to retreat?Masayoshi Son answered